Short Sale Guide for Essex County Homeowners Facing Foreclosure

What is a Short Sale? Complete Guide for Essex County Homeowners Facing Foreclosure

If you're behind on your mortgage payments and facing the possibility of foreclosure in Essex County, you've probably heard the term "short sale" mentioned as an alternative. But what exactly is a short sale, and could it be the solution that saves your credit and helps you avoid the devastating impact of foreclosure?

As someone who has guided dozens of Essex County homeowners through successful short sales, I've seen how this option can provide a lifeline when foreclosure seems inevitable. However, I've also witnessed the costly mistakes that homeowners make when they don't fully understand the short sale process or try to navigate it alone.

This comprehensive guide will explain exactly what a short sale means for Essex County homeowners, how long the process actually takes in our local market, and the critical misconceptions that could cost you thousands of dollars or valuable time you don't have.

What is a Short Sale?

A short sale occurs when you sell your home for less than what you owe on your mortgage, and your lender agrees to accept the reduced payoff amount and forgive the remaining debt. Essentially, you're selling your home "short" of the full mortgage balance.

Here's how it works in practical terms: if you owe $400,000 on your mortgage but your Essex County home is now only worth $320,000 due to market conditions, a short sale would involve selling the property for $320,000 and asking your lender to accept this amount as payment in full, forgiving the $80,000 difference.

The keyword here is "agrees" – your lender must approve the short sale. This isn't automatic, and the approval process involves extensive documentation, financial hardship proof, and often months of negotiation.

Why Consider a Short Sale in Essex County?

Alternative to Foreclosure

A short sale provides an exit strategy when you can no longer afford your mortgage payments and owe more than your home's current market value. Rather than letting the foreclosure process destroy your credit and potentially leave you liable for deficiency judgments, a short sale offers a more controlled exit.

Credit Impact Comparison

While both foreclosure and short sale negatively impact your credit score, foreclosure is generally more damaging and stays on your credit report longer. A short sale typically reduces your credit score by 50-160 points, while foreclosure can drop it by 200-400 points.

Faster Recovery Timeline

After a short sale, you may be eligible for a new mortgage in as little as 2-3 years with good credit rebuilding. Foreclosure typically requires a 7-year waiting period for conventional loans.

How Long Does a Short Sale Take in Essex County?

Based on current market conditions and lender processing times, here's what Essex County homeowners can realistically expect:

Average Timeline: 4-5 Months

Most short sales in Essex County take between 4-5 months from the initial listing to final closing. However, this timeline can vary dramatically based on several factors.

Range of Possibilities

I've seen some Essex County short sales approved in as little as 10 days when all documentation was perfect and the lender was motivated. On the other end, complex cases involving multiple liens or unresponsive lenders have taken over 12 months.

Factors Affecting Your Timeline

Lender Responsiveness: Some banks process short sale packages within 60 days, while others routinely take 6+ months. Wells Fargo, Bank of America, and Chase each have different internal processes and timelines.

Documentation Completeness: Incomplete hardship packages are the #1 cause of delays. Missing tax returns, bank statements, or hardship letters can add months to your timeline.

Property Condition: Homes requiring significant repairs or having title issues face longer approval periods.

Multiple Liens: If you have a second mortgage, HELOC, or liens from contractors or the IRS, each must separately approve the short sale terms.

Market Activity: Properties in desirable Essex County neighborhoods like Montclair or West Orange may attract buyers quickly, while homes in slower markets may sit for months before generating offers.

The Short Sale Process: Step by Step

Phase 1: Pre-Approval Preparation (30-60 Days)

Before listing your Essex County property, you'll need to:

-

Document financial hardship with a detailed letter

-

Gather 2 years of tax returns, recent pay stubs, and bank statements

-

Obtain a Broker Price Opinion (BPO) or appraisal

-

Submit a complete short sale package to the lender

Phase 2: Marketing and Buyer Search (30-90 Days)

Once approved for short sale consideration:

-

List property at market value (not short sale price)

-

Market to attract qualified buyers

-

Review and negotiate offers

-

Submit the accepted offer to the lender for approval

Phase 3: Lender Approval Process (60-120 Days)

The most unpredictable phase:

-

Lender orders a BPO or appraisal

-

Underwriter reviews the complete file

-

Negotiation of terms, including potential deficiency waiver

-

Final approval or counteroffer issued

Phase 4: Closing (30-45 Days)

Similar to traditional sales:

-

Title work and inspections completed

-

Final lender conditions satisfied

-

Closing scheduled and completed

5 Short Sale Myths That Cost Essex County Homeowners Money

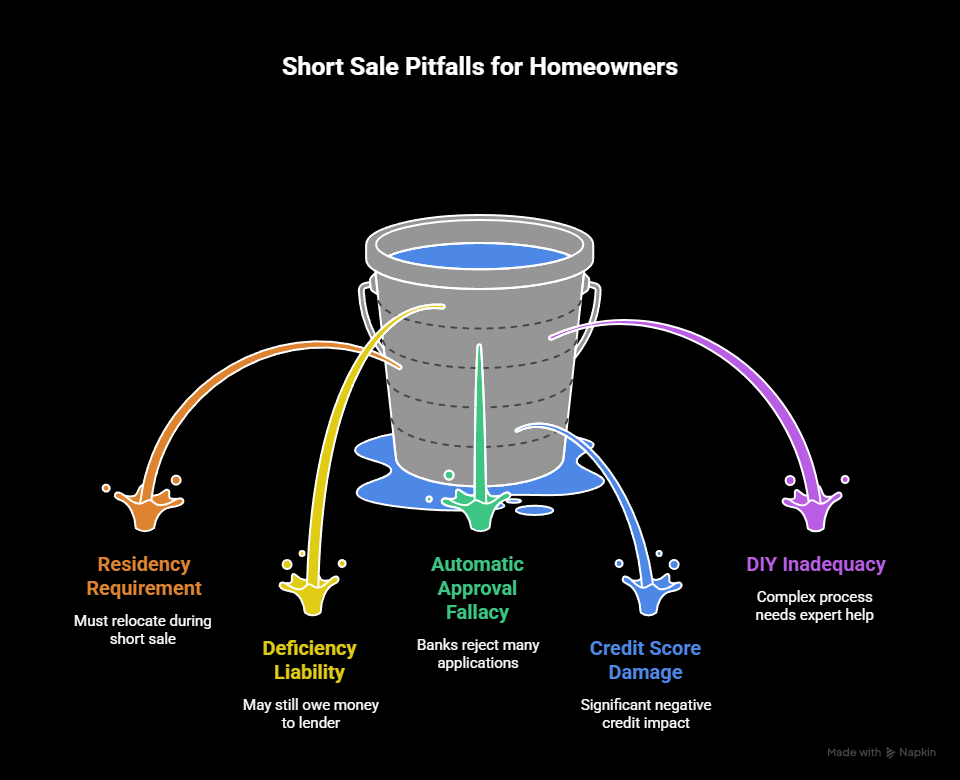

Myth #1: "I Can Stay in My Home During a Short Sale"

Reality: Most lenders require proof that you're relocating as part of your financial hardship. You typically cannot complete a short sale and continue living in the property. Some homeowners waste months pursuing short sales when they're not actually planning to move.

Myth #2: "Short Sale Means I Won't Owe Any Money"

Reality: Without a specific deficiency waiver, you may still owe the difference between your mortgage balance and the sale price. In New Jersey, lenders can pursue deficiency judgments for up to 6 years after a short sale. Always negotiate deficiency forgiveness as part of your short sale approval.

Myth #3: "Banks Will Automatically Approve My Short Sale"

Reality: Lenders reject approximately 40% of short sale applications. Common rejection reasons include:

-

Insufficient financial hardship documentation

-

Property is priced too low compared to the market value

-

Borrower has significant liquid assets

-

Suspicion of fraud or collusion between buyer and seller

Myth #4: "Short Sale Doesn't Hurt Credit as Much as Foreclosure"

Reality: While generally less damaging than foreclosure, a short sale still significantly impacts your credit score. Expect a 50-160 point drop and "settlement for less than owed" notations on your credit report for 7 years. Plan accordingly for future financing needs.

Myth #5: "I Can Do a Short Sale Myself Without an Agent"

Reality: Short sales involve complex negotiations with loss mitigation departments, extensive paperwork requirements, and strict deadlines. Most self-represented homeowners either get their short sale rejected or accept unfavorable terms that could have been negotiated differently.

Who Qualifies for a Short Sale in Essex County?

Financial Requirements

-

You must be experiencing genuine financial hardship

-

Monthly mortgage payments exceed 31% of gross monthly income

-

You have limited liquid assets (typically less than 2-4 months of mortgage payments)

-

Your home's current market value is less than your total mortgage debt

Common Qualifying Hardships

-

Job loss or significant income reduction

-

Medical emergencies or disability

-

Divorce or the death of a spouse

-

Military deployment or relocation

-

Business failure or bankruptcy

-

ARM payment increases you cannot afford

Property Requirements

-

You must occupy the property as your primary residence (for most programs)

-

Property condition must not be deliberately neglected

-

No recent cash-out refinances or equity loans for non-essential purposes

Essex County Market Considerations

Current Market Conditions

Essex County's real estate market has experienced significant fluctuations, with some areas maintaining value better than others. Neighborhoods like Montclair, South Orange, and West Orange have shown more stability, while other areas have seen steeper declines that make short sales more likely.

Local Lender Relationships

Having experience with local Essex County lenders, title companies, and appraisers can significantly impact your short sale timeline. Some lenders have preferred vendor lists that expedite the process.

New Jersey Specific Laws

New Jersey is a judicial foreclosure state, meaning foreclosures must go through the court system. This typically provides more time to pursue short sale alternatives compared to non-judicial foreclosure states.

Tax Implications of Short Sales

Federal Tax Considerations

The Mortgage Forgiveness Debt Relief Act provides some protection, but tax implications vary based on your specific situation. Forgiven debt may be considered taxable income unless you qualify for insolvency or principal residence exemptions.

New Jersey State Taxes

New Jersey generally follows federal tax treatment of forgiven mortgage debt, but consult with a tax professional for your specific situation.

When Short Sale Might Not Be Right

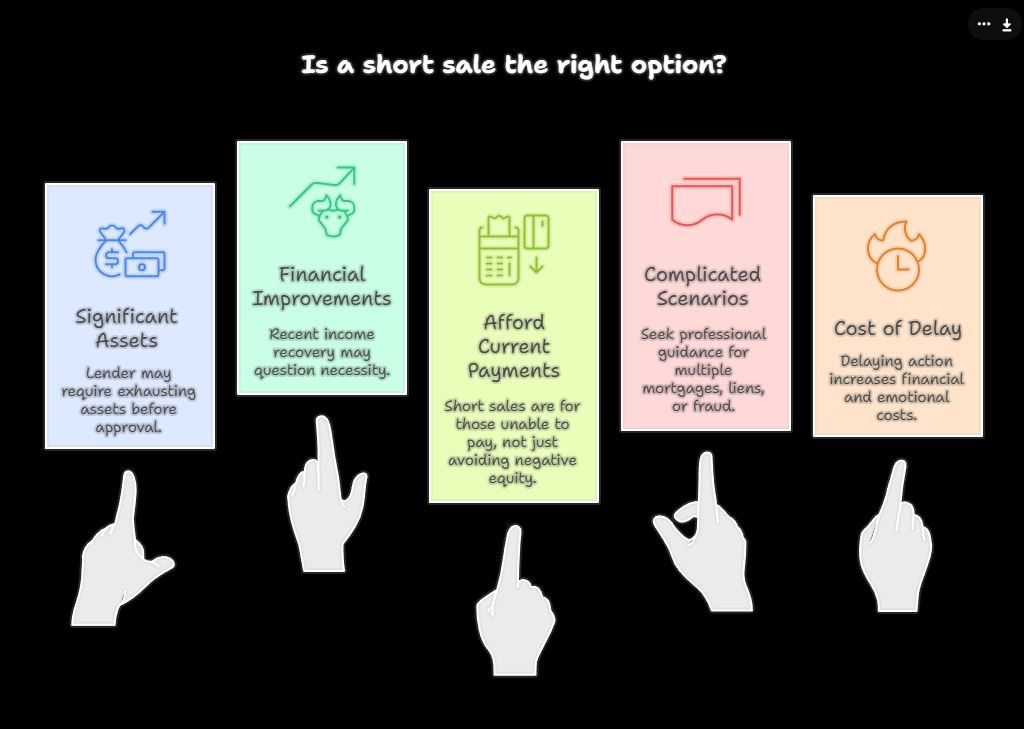

You Have Significant Assets

If you have substantial savings, retirement accounts, or other real estate, your lender may require you to exhaust these resources before approving a short sale.

Recent Financial Improvements

If your income has recovered or you've received a windfall, lenders may question the necessity of a short sale.

You Can Afford Current Payments

Short sales are for homeowners who cannot continue making mortgage payments, not those simply wanting to get out from under negative equity.

Red Flags: When Short Sales Get Complicated

Seek immediate professional guidance if your Essex County short sale involves:

-

Multiple mortgages or liens from different lenders

-

IRS tax liens or judgments

-

Properties owned by LLCs or trusts

-

Suspected fraud or misrepresentation in the original loan application

-

Divorce proceedings with disagreements about the sale

-

HOA liens or special assessments

-

Properties with significant code violations or habitability issues

The Cost of Delay: Why Timing Matters

Every month you delay addressing your mortgage problems in Essex County costs you:

Financial Costs

-

Additional missed mortgage payments are damaging your credit

-

Accumulating late fees and interest

-

Potential deficiency judgment is growing larger

-

Foreclosure attorney fees if the process begins

Emotional Costs

-

Increased stress and uncertainty for your family

-

Limited housing options as the credit score deteriorates

-

Foreclosure proceedings becoming public record

Strategic Costs

-

Fewer buyer options as the property sits on the market longer

-

Declining property values in a down market

-

Loss of control over timeline and outcome

Taking Control: Your Next Steps

If you're facing the possibility of foreclosure in Essex County, you have options. The key is acting quickly while you still have time to explore alternatives like short sales.

The short sale process is complex, with strict deadlines and extensive documentation requirements. Success depends on proper preparation, accurate market pricing, and skilled negotiation with loss mitigation departments.

Don't let misconceptions about short sales cost you valuable time or money. Every day you wait reduces your options and potentially increases your financial liability.

Frequently Asked Questions About Short Sales in Essex County

❓ How long does a short sale take in New Jersey?

A short sale in New Jersey typically takes 4–5 months from listing to closing. Some can move faster, around 60 days, if documents are complete and the lender is motivated. Others may take longer if there are multiple liens or delays from the bank. You can see how timing impacts sellers in my latest North Jersey Housing Market Snapshot.

❓ Will I owe money after a short sale in Essex County?

It depends. In New Jersey, lenders can pursue a deficiency judgment for the difference between the mortgage balance and the sale price. Always ask your lender for a deficiency waiver in writing to avoid being responsible for the leftover balance. For guidance, read my client reviews where I explain how I’ve negotiated waivers for past clients.

❓ Can a short sale stop foreclosure in Essex County?

Yes. A short sale is one of the most common ways to avoid foreclosure in New Jersey. Once the lender approves your short sale, the foreclosure process is usually paused or stopped, giving you more control over the outcome. If you’re unsure about your options, check out my About page to learn how I help families facing foreclosure.

❓ Does a short sale hurt my credit as much as foreclosure?

No. A short sale will still impact your credit, usually dropping it 50–160 points, but foreclosure can drop your score by 200–400 points and stays on your record longer. Short sales also allow you to qualify for a new mortgage faster, sometimes in as little as 2–3 years. Use my free Mortgage Calculator to see how a new loan could look once you’ve rebuilt your credit.

❓ Do I need a real estate agent for a short sale?

Yes. A short sale involves complex negotiations, strict deadlines, and detailed paperwork. Without an experienced short-sale Realtor, homeowners often face rejection or lose money they could have saved with proper negotiation. That’s why so many in Essex County trust me; see their words on my Reviews page.

❓ Who is the best short sale Realtor in Essex County?

I’m Johnny Rodriguez, North Jersey’s First AI-Certified Realtor, Short Sale Certified, and Probate Specialist. I’ve guided dozens of Essex County homeowners through successful short sales, helping them avoid foreclosure while protecting their financial future. Learn more about my approach on my About page.

Schedule Your Free Essex County Short Sale Consultation

I've successfully guided dozens of Essex County homeowners through the short sale process, helping them avoid foreclosure while minimizing the impact on their credit and future housing options. Every situation is unique, and the strategies that work for a Montclair colonial are different from those needed for a Newark multi-family property.

Call today to discuss your specific situation: +1(973) 390-7319

During your consultation, we'll review:

-

Your exact qualification requirements based on hardship and property value

-

Realistic timeline expectations for your specific lender and property type

-

Documentation needed to avoid common rejection reasons

-

Strategies to negotiate deficiency forgiveness

-

How Essex County market conditions affect your short sale options

-

Step-by-step action plan to move forward immediately

Time is critical when facing foreclosure. The sooner you explore your short sale options, the more control you maintain over the outcome.

Don't navigate this complex process alone. Get the expert guidance you need to make informed decisions about your Essex County property and your family's financial future.

Schedule your confidential consultation today – before foreclosure proceedings begin.

Categories

- All Blogs (965)

- North Jersey Real Estate (327)

- 1. Probate & Estate Sales in Passaic County (1)

- 55+ Communities (3)

- A.I. Certified Realtor (359)

- Active Adult & 55+ Living in North Jersey (1)

- Active Adult Living (3)

- Affordable Commercial Real Estate Paterson NJ (1)

- Affordable Homes Near Top Schools (1)

- Affordable Housing and Multi Family Rentals (1)

- Affordable North Jersey Fall Events (1)

- AI Real Estate Marketing (1)

- AI Real Estate Strategy (1)

- AI Realtor Advice (1)

- AI Realtor Advice & Tips (1)

- AI Realtor Picks (1)

- AI-Driven Home Pricing & Strategy (1)

- AI-Driven Real Estate Expertise (1)

- AI-Driven Real Estate Guidance (1)

- AI-Driven Real Estate Strategies (1)

- AI-Enhanced Real Estate Strategies (1)

- AI-Powered Home Buying & Selling (1)

- AI-Powered Home Selling Strategies (4)

- AI-Powered Home Valuation (1)

- AI-Powered Homebuyer Strategies (1)

- AI-Powered Homebuying Strategies (1)

- AI-Powered Probate Strategies (2)

- AI-Powered Real Estate (6)

- AI-Powered Real Estate Insights (2)

- AI-Powered Real Estate Marketing (4)

- AI-Powered Real Estate Solutions (3)

- AI-Powered Real Estate Strategies (1)

- AI-Powered Real Estate Strategy (2)

- Art and Culture in New Jersey (1)

- Arts, Culture, and Entertainment in North Jersey (1)

- Arts, Culture, and Local Events in New Jersey (1)

- Avoid Foreclosure in NJ (2)

- Avoiding Foreclosure Strategies (1)

- Behind on Mortgage? Start Here (1)

- Bergen & Passaic County Events (1)

- Bergen & Passaic County Guides (3)

- Bergen & Passaic County Living (4)

- Bergen & Passaic County Resources (1)

- Bergen and Passaic County Comparison (1)

- Bergen County Community and Real Estate Insights (1)

- Bergen County Community Events (1)

- Bergen County Community Guide (1)

- Bergen County Festivals and Events (1)

- Bergen County Foreclosure Help (1)

- Bergen County Home Buying (2)

- Bergen County Homeowner Resources (1)

- Bergen County Homes for Sale (1)

- Bergen County Housing Market (2)

- Bergen County Investment Properties (1)

- Bergen County Lifestyle & Events (2)

- Bergen County Market (2)

- Bergen County Neighborhoods and Schools (1)

- Bergen County Outdoor Living (1)

- Bergen County Projects (1)

- Bergen County Real Estate (7)

- Bergen County Real Estate Advice (1)

- Bergen County Real Estate and Investment Strategies (1)

- Bergen County Real Estate and Relocation Insights (1)

- Bergen County Real Estate and Relocation Resources (1)

- Bergen County Real Estate Guides (1)

- Bergen County Real Estate Insights (4)

- Bergen County Real Estate Investing (1)

- Bergen County Real Estate Market (1)

- Bergen County Real Estate Opportunities (1)

- Bergen County Real Estate Resources (3)

- Bergen County Weekend & Travel Guides (1)

- Best NJ School Districts (1)

- Best places to eat in North Jersey (3)

- Best Places to Live in NJ (1)

- Best School Districts & Family-Friendly Homes (1)

- Best Towns to Move to in North Jersey (1)

- Best Towns to Raise a Family in NJ (1)

- Budget Travel (1)

- Budget-Friendly Activities NJ (1)

- Budget-Friendly Activities North Jersey (1)

- Budget-Friendly Things to Do (1)

- Business & Entrepreneurship in North Jersey (1)

- Business Location and Expansion Guides (1)

- Business Networking & Entrepreneurship (1)

- Buyer & Investor Education (1)

- Buyer & Investor Guides (1)

- Buyer & Investor Strategies (1)

- Buyer & Seller Guides (1)

- Buyer and Investor Education (1)

- Buyer and Investor Guides (1)

- Buyer Migration Insights (1)

- Buyer Trends 2025 (1)

- Buying a Home in NJ (1)

- Buying a Home in North Jersey (5)

- Buying Real Estate in Totowa NJ (1)

- Buying, Selling, and Investing Strategies (2)

- Buying, Selling, and Leasing Commercial Property (1)

- Career Growth Opportunities (1)

- Cheese, Beer, and Wine Festivals in Jersey City (1)

- Clifton and Paramus Home Buying Guides (2)

- Clifton and Paramus Real Estate (1)

- Clifton Community Events (1)

- Clifton Community Events and Local Guides (1)

- Clifton NJ Condo and Townhome Guides (1)

- Clifton NJ Home Buying and Selling (1)

- Clifton NJ Homebuyer Resources (1)

- Clifton NJ Homes & Neighborhoods (3)

- Clifton NJ Homes & Real Estate (1)

- Clifton NJ Real Estate (4)

- Clifton NJ Real Estate Guides (2)

- Clifton NJ Real Estate Insights (1)

- Clifton NJ Real Estate Investment Guides (1)

- Clifton NJ Real Estate Market (5)

- Clifton NJ Real Estate Tips (1)

- Clifton NJ Real Estate Trends (1)

- Clifton NJ Short Sales (1)

- Clifton Parks, Trails, and Community Resources (1)

- Clifton Real Estate (1)

- Clifton Real Estate and Community Guides (1)

- Clifton Real Estate and Local Market Insights (1)

- Clifton vs Paramus Homebuyer Insights (1)

- Clifton vs Paramus Market Comparisons (1)

- Commercial Real Estate Leasing (1)

- Commercial Real Estate Opportunities (1)

- Community & Lifestyle Guides (2)

- Community Amenities (1)

- Community Events (1)

- Community Favorites (1)

- Community Guides Paterson NJ (2)

- Community Highlights (5)

- Community Highlights for Buyers (1)

- Community Living (1)

- Community Resources (1)

- Community Spotlights for Homebuyers (1)

- Commuter Towns Near NYC (1)

- Comparative Market Analysis and Appraisal Guidance (1)

- Competitive Offer and Negotiation Tips (1)

- Condo Short Sales & Foreclosure Alternatives (1)

- Credit & Homeownership Recovery (1)

- Credit Impact and Recovery Guides (1)

- Cultural Attractions in North Jersey (1)

- Cultural Life in Passaic & Bergen County (1)

- Date night spots NJ (1)

- Dining & Local Hotspots (1)

- Distressed Homeowner Resources and Solutions (3)

- Distressed Homeowner Solutions (2)

- Distressed Property & Short Sale Real Estate (1)

- Distressed Property Solutions (10)

- Down Payment & Closing Cost Assistance (1)

- Down Payment Assistance (1)

- Elmwood Park NJ Community Guides (1)

- Elmwood Park NJ Real Estate Guides (2)

- Elmwood Park NJ Real Estate Resources (1)

- Elmwood Park Real Estate (3)

- Essex County Home Sales (2)

- Essex County Homeowner Guides (1)

- Essex County Probate Costs & Fees (1)

- Essex County Real Estate (4)

- Estate Planning & Home Selling Guides (1)

- Estate Planning & Property Sales (1)

- estate property sale in Totowa NJ (1)

- Executor & Estate Guidance (1)

- Executor Resources (1)

- Explore Clifton NJ (1)

- Explore North Jersey Neighborhoods (2)

- Fall Activities for Kids and Families (1)

- Family & Community Living in North Jersey (1)

- Family & Lifestyle in North Jersey (1)

- Family Activities & Outdoor Fun (1)

- Family Activities in North Jersey (1)

- Family Friendly Living in Paramus NJ (1)

- Family Fun & Outdoor Activities (4)

- Family Fun & Things To Do in New Jersey (1)

- Family Fun in North Jersey (1)

- Family Homes and Lifestyle (1)

- Family Homes in Bergen and Passaic County (1)

- Family Living in North Jersey (3)

- Family Relocation & Lifestyle (1)

- Family Relocation Advice (1)

- Family Relocation Tips (4)

- Family-Friendly Activities in New Jersey (1)

- Family-Friendly Activities in North Jersey (2)

- Family-Friendly Activities NJ (7)

- Family-Friendly Communities (2)

- Family-Friendly Communities in New Jersey (4)

- Family-friendly dining NJ (1)

- Family-Friendly Events in North Jersey (1)

- Family-Friendly Festivals in North Jersey (1)

- Family-Friendly Food Truck Festivals in North Jersey (1)

- Family-Friendly Living (1)

- Family-Friendly Neighborhoods (1)

- Family-Friendly NJ Living (1)

- Family-Friendly Real Estate in North Jersey (1)

- Family-Friendly Relocation (1)

- Family-Friendly Things To Do in New Jersey (2)

- Family-Friendly Things to Do in North Jersey (1)

- Farmers Markets & Pop-Ups (1)

- Featured Community Spotlights (8)

- Festivals & Food Experiences (1)

- Financial Hardship and Credit Recovery Advice (1)

- Financial Recovery and Real Estate Guidance (1)

- Financing & Homeownership Tips (1)

- Financing and Mortgage Education (1)

- First Time Buyer Financing Guides (1)

- First Time Home Buyer Guides (4)

- First Time Home Buyer Resources (1)

- First Time Homebuyer Resources (2)

- First-Time Buyer Education (1)

- First-Time Buyer Resources (1)

- First-Time Buyer Tips in North Jersey (1)

- First-Time Home Buyer Guides in North Jersey (5)

- First-Time Home Buyer Guides NJ (5)

- First-Time Home Buyer Programs in New Jersey (2)

- First-Time Home Buyer Resources (2)

- First-Time Home Buyer Tips (6)

- First-Time Homebuyer & Seller Resources (1)

- First-Time Homebuyer Guides (3)

- First-Time Homebuyer Guides & Resources (1)

- First-Time Homebuyer Resources in New Jersey (2)

- First-Time Homebuyer Tips (3)

- First-Time Homebuyers (5)

- Fixer Upper and Renovation Tips (1)

- Food & Music Festivals in New Jersey (1)

- Food spots near me (1)

- Food, Culture, and Lifestyle in North Jersey (1)

- For Homeowners in Financial Distress (1)

- Foreclosure Alternatives (3)

- Foreclosure Alternatives & Distressed Property Solutions (1)

- Foreclosure Alternatives & Short Sales (2)

- Foreclosure Alternatives in Essex County (2)

- Foreclosure Alternatives in New Jersey (2)

- Foreclosure Alternatives in NJ (2)

- Foreclosure Alternatives in North Jersey (1)

- Foreclosure Help (5)

- Foreclosure Help & Alternatives (1)

- Foreclosure Help & Prevention (1)

- Foreclosure Prevention and Homeowner Resources (1)

- Foreclosure Prevention and Strategy (1)

- Foreclosures (1)

- Free Things to Do in NJ (1)

- Free Things to Do in North Jersey (4)

- Guides for Non-US Property Owners (1)

- Hackensack Home Buying and Investment Resources (1)

- Hackensack Home Buying and Market Insights (1)

- Hackensack Home Buying Resources (1)

- Hackensack Housing Market (1)

- Hackensack Luxury Real Estate (1)

- Hackensack NJ Homeowner Guides (1)

- Hackensack NJ Homes (1)

- Hackensack NJ Housing Market (1)

- Hackensack NJ Short Sale Homes (1)

- Hackensack Real Estate (5)

- Hackensack Real Estate Market Guides (1)

- Haledon & Passaic County Home Selling Guides (1)

- Haledon & Passaic County Living (1)

- Haledon and Passaic County Real Estate Insights (1)

- Healthy Homeowner Habits (1)

- Healthy Living & Organic Produce (1)

- Hidden gem restaurants in NJ (2)

- Hidden Gems in New Jersey (7)

- Historic Real Estate North Jersey (1)

- Historic Sites & Landmarks (1)

- History & Culture (1)

- HOA & Closing Logistics (1)

- Hoboken and Jersey City Housing Market Trends (1)

- Hoboken and Jersey City Lifestyle (1)

- Hoboken Market & Building Guides (1)

- Home Buyer Insights (1)

- Home Buying & Building Guides (1)

- Home Buying & Investment Strategies (1)

- Home Buying & Investment Tips (1)

- Home Buying & Relocation Resources (2)

- Home Buying & Selling Resources (1)

- Home Buying & Selling Tips (3)

- Home Buying Advice (1)

- Home Buying and Investment Tips (1)

- Home Buying and Selling Tips (1)

- Home Buying in Bergen & Passaic County (1)

- Home Buying in NJ (2)

- Home Buying Tips (10)

- Home Buying Tips & Local Expertise (1)

- Home Buying Tips & Local Insights (1)

- Home Buying Tips & Strategies (1)

- Home Buying Tips New Jersey (1)

- Home Financing & Mortgage Programs (1)

- Home Improvement and ROI (1)

- Home Improvements That Add Value (1)

- Home Inspection and Repairs (1)

- Home Inspection Tips for Buyers (1)

- Home Inspections and Due Diligence (1)

- Home Pricing & Market Strategy (1)

- Home Pricing and Valuation (1)

- Home Renovation and Investment Strategies (1)

- Home Selling & Buying Insights (1)

- Home Selling & Market Trends (2)

- Home Selling Advice and Strategy (2)

- Home Selling Advice for New Jersey Homeowners (2)

- Home Selling Advice in New Jersey (2)

- Home Selling Advice in North Jersey (1)

- Home Selling Challenges & Solutions (1)

- Home Selling Costs & Strategy (1)

- Home Selling Guidance (1)

- Home Selling Guidance & Strategies (1)

- Home Selling Guides & Resources (1)

- Home Selling Guides for North Jersey (5)

- Home Selling Guides in Bergen County (1)

- Home Selling Process & Guides (1)

- Home Selling Process & Legal Guides (1)

- Home Selling Resources in Bergen County (1)

- Home Selling Strategies (10)

- Home Selling Strategies & AI Insights (1)

- Home Selling Strategies & Insights (1)

- Home Selling Strategies 2025 (1)

- Home Selling Strategies in North Jersey (1)

- Home Selling Strategy and Seasonal Preparation (1)

- Home Selling Strategy and Timing (1)

- Home Selling Strategy for Distressed Owners (1)

- Home Selling Tips & Neighborhood Guides (1)

- Home Selling Tips & Preparation (1)

- Home Selling Tips & Pricing Strategies (1)

- Home Selling Tips & Strategies (6)

- Home Selling Tips and Strategies (1)

- Home Selling Tips and Value Boosting Strategies (1)

- Home Selling Tips for Executors (1)

- Home Selling Tips for Heirs and Executors (1)

- Home Selling Tips in New Jersey (3)

- Home Selling Tips in North Jersey (2)

- Home Staging & Curb Appeal (1)

- Home Staging & Design Strategies (1)

- Home Staging & Value-Boosting Strategies (1)

- Home Valuation & Market Insights (1)

- Home Value & Seller Insights (1)

- Home Value Trends & Pricing Insights (2)

- Home Values & Pricing Strategy (1)

- Homebuyer Education & Real Estate Tips (1)

- Homebuyer Education and Family Resources (1)

- Homebuyer Resources (1)

- Homebuyer Tips & Checklists (1)

- Homeowner and Family Resources (1)

- Homeowner Education (2)

- Homeowner Financial & Credit Education (1)

- Homeowner Financial Hardship Solutions (1)

- Homeowner Financial Relief (1)

- Homeowner Financial Relief & Buyer Opportunities (2)

- Homeowner Financial Relief & Investment Opportunities (1)

- Homeowner Financial Resources (1)

- Homeowner Guides (1)

- Homeowner Lifestyle Tips (4)

- Homeowner Resources (5)

- Homeowner Resources & Financial Relief (1)

- Homes for Sale in Montclair NJ (1)

- Homes for Sale in North Jersey (1)

- Homes for Sale in Westfield NJ (1)

- Homes for Sale in Wyckoff NJ (1)

- Housing Inventory (1)

- Housing Market 2025 (3)

- Housing Market Analysis 2025 (1)

- Housing Market Trends (1)

- Hudson County Events and Activities (1)

- Hudson County Lifestyle & Community Highlights (1)

- Hudson County Probate Real Estate (2)

- Hudson County Real Estate Guides (3)

- Hudson County Real Estate Market Trends (2)

- Hudson County Real Estate Programs (1)

- Hudson County Seller Guides (2)

- Income Producing Homes and Market Trends (1)

- Industrial and Warehouse Property Guides (1)

- Inherited Property & Estate Sales (1)

- Inherited Property & Estate Sales NJ (2)

- Inherited Property and Tax Implications in New Jersey (1)

- Inherited Property Guidance (3)

- Inherited Property Selling Solutions (1)

- Investment & Opportunity Properties (1)

- Investment Properties (1)

- Investment Properties & Multi-Family Homes (1)

- Investment Property & Buyer Trends (1)

- Investment Property & Home Selling Strategies (1)

- Investment Property & Selling Strategies (1)

- Investment Property Opportunities (1)

- Investor & Landlord Real Estate Insights (1)

- Investor Opportunities in Probate and Estate Sales (1)

- Investor Strategies (1)

- Jersey City & Hoboken Housing Prices 2025 (1)

- Jersey City Arts & Culture (1)

- Jersey City Culture & Nightlife (1)

- Jersey City Nightlife & Entertainment (1)

- Jersey City Real Estate Guides (1)

- Johnny Rodriguez Realtor Insights (3)

- Johnny’s Local Picks (5)

- Land Use and Zoning Guides (1)

- Lifestyle & Community Advantages (1)

- Lifestyle & Community Benefits (1)

- Lifestyle & Local Culture (1)

- Lifestyle & Local Living (1)

- Lifestyle & Local Travel Guides (1)

- Lifestyle & Relocation Guides (1)

- Lifestyle and Community (1)

- Lifestyle and Local Culture in North Jersey (1)

- Lifestyle in Passaic & Bergen County (1)

- Live Music and Concerts in North Jersey (1)

- Living in Bergen and Passaic County (4)

- Living in Haledon and Passaic County (2)

- Living in Haledon NJ (1)

- Local Arts & Music Scene (1)

- Local Attractions & Events (1)

- Local Attractions & Travel (2)

- Local Community Highlights (2)

- Local Events & Guides (1)

- Local Events & Lifestyle (2)

- Local Events & Seasonal Guides (3)

- Local Events and Cultural Experiences (1)

- Local Events and Family Experiences (1)

- Local Events in North Jersey (4)

- Local Events North Jersey (1)

- Local Farms & CSA Programs (1)

- Local Farms & Markets (1)

- Local Food & Dining (1)

- Local Food & Wellness (1)

- Local Food Festivals in New Jersey (1)

- Local food spots in NJ (1)

- Local Guides & Community Spotlights (1)

- Local Lifestyle & Community (9)

- Local Lifestyle and Community Insights (1)

- Local lifestyle in North Jersey (5)

- Local lifestyle North Jersey (3)

- Local Living & Lifestyle (1)

- Local Market & Neighborhood Guides (1)

- Local Market Insights (North Jersey & Hudson County) (1)

- Local Market Movement (1)

- Local Parks and Nature Trails (1)

- Local Saddle Brook and Bergen County Real Estate Guides (1)

- Local Travel (5)

- Local Travel & Recreation (1)

- Luxury Homes & Lifestyle (1)

- Luxury Homes & Rental Communities (1)

- Luxury Homes in North Jersey (1)

- Market Insights & Investment Opportunities (1)

- Market Insights for Sellers (1)

- Market Trends 2025 (1)

- Market Trends and Neighborhood Insights (1)

- Market Trends and Timing (1)

- Maximizing ROI for Sellers (1)

- Montclair Festivals & Community Markets (1)

- Montclair Lifestyle & Community Highlights (1)

- Montclair Sports & Fitness Festivals (1)

- Morristown Lifestyle & Community Highlights (1)

- Mortgage & Down Payment Assistance (1)

- Mortgage & Financing (1)

- Mortgage & Loan Eligibility Guides (1)

- Mortgage and Financing Guides (1)

- Mortgage Relief & Distressed Property (2)

- Moving to North Jersey (2)

- Moving to North Jersey with Kids (2)

- Moving with Kids (1)

- Multi-Family & Investment Properties (1)

- Multi-Family Investment Properties (1)

- Multi-Family Property Selling Tips (1)

- Multi-Family Real Estate (1)

- Nature & Outdoors (1)

- Neighborhood and School District Insights (1)

- Neighborhood Guides and Relocation Tips (1)

- Neighborhood Highlights (1)

- Neighborhood restaurants NJ (1)

- New Construction and Redevelopment Insights (1)

- New Jersey Distressed Property Guides (1)

- New Jersey Down Payment Assistance & FHA Loans (1)

- New Jersey Estate & Tax Guides (1)

- New Jersey First Time Home Buyer Resources (1)

- New Jersey Home Selling Guides (4)

- New Jersey Housing Market Updates (2)

- New Jersey Mortgage and Assistance Programs (1)

- New Jersey property taxes (1)

- New Jersey Real Estate Market Trends (2)

- NJ Home Price Predictions (1)

- NJ Home Price Trends (1)

- NJ Home Prices 2025 (1)

- North Haledon NJ Real Estate Market (2)

- North Jersey Architecture & History (1)

- North Jersey Arts & Culture (1)

- North Jersey Arts and Lifestyle (1)

- North Jersey Arts, Culture & Nightlife (1)

- North Jersey Arts, Music, and Community (1)

- North Jersey Attractions (1)

- North Jersey Buyer and Investor Resources (1)

- North Jersey Coffee Shops (1)

- North Jersey Commercial Market Insights (2)

- North Jersey Commercial Real Estate (2)

- North Jersey Communities & Lifestyle (1)

- North Jersey Community Events (5)

- North Jersey Community Guides (3)

- North Jersey Commute Guides (1)

- North Jersey Cost of Living (1)

- North Jersey Events & Entertainment (1)

- North Jersey Events & Lifestyle (1)

- North Jersey Events & Nightlife (1)

- North Jersey Events and Festivals (1)

- North Jersey Events and Lifestyle (2)

- North Jersey Fall Festivals and Pumpkin Patches (1)

- North Jersey Food and Lifestyle (1)

- North Jersey Food Festivals & Events (1)

- North Jersey Guides (1)

- North Jersey Home Buying Guide (1)

- North Jersey Home Buying Guides (5)

- North Jersey Home Buying Requirements (1)

- North Jersey Home Buying Resources (1)

- North Jersey Home Buying Strategies (1)

- North Jersey Home Buying Tips (2)

- North Jersey Homebuyer Resources (1)

- North Jersey Homebuyers (1)

- North Jersey Housing Affordability (1)

- North Jersey Housing Market (1)

- North Jersey Lifestyle (18)

- North Jersey Lifestyle & Communities (4)

- North Jersey Lifestyle & Community (5)

- North Jersey Lifestyle & Community Guides (2)

- North Jersey Lifestyle & Community Highlights (2)

- North Jersey Lifestyle & Culture (1)

- North Jersey Lifestyle & Events (3)

- North Jersey Lifestyle & Living (1)

- North Jersey Lifestyle & Outdoors (1)

- North Jersey Lifestyle & Travel (2)

- North Jersey Lifestyle and Community Guides (3)

- North Jersey Lifestyle and Entertainment (1)

- North Jersey Lifestyle and Events (1)

- North Jersey Lifestyle and Seasonal Guides (1)

- North Jersey Living (6)

- North Jersey Luxury Home Living (1)

- North Jersey Market Guides (3)

- North Jersey Market Insights (5)

- North Jersey Market Trends (1)

- North Jersey Market Trends & Reports (1)

- North Jersey Market Trends and Forecasts (1)

- North Jersey Market Trends and Housing Insights (1)

- North Jersey Mortgage and Financing Guides (1)

- North Jersey Multi Family Properties (1)

- North Jersey Multi-Family Homes (1)

- North Jersey Neighborhood Guides (14)

- North Jersey Neighborhood Spotlights (1)

- North Jersey Nightlife & Entertainment (2)

- North Jersey Outdoor Adventures (1)

- North Jersey Outdoor Lifestyle Guides (1)

- North Jersey Outdoor Photography (1)

- North Jersey Outdoors & Recreation (1)

- North Jersey Property Market Reports (1)

- North Jersey Property Valuation & Trends (1)

- North Jersey Real Estate (22)

- North Jersey Real Estate Advice (4)

- North Jersey Real Estate Education (4)

- North Jersey Real Estate for Cash Buyers (1)

- North Jersey Real Estate for Investors (1)

- North Jersey Real Estate Guidance (1)

- North Jersey Real Estate Guides (20)

- North Jersey Real Estate Insights (17)

- North Jersey Real Estate Listings (1)

- North Jersey Real Estate Market 2025 (1)

- North Jersey Real Estate Market and Neighborhood Insights (1)

- North Jersey Real Estate Market Insights (29)

- North Jersey Real Estate Market Trends (3)

- North Jersey Real Estate Market Updates (6)

- North Jersey Real Estate Strategy (1)

- North Jersey Real Estate Tips & Guides (3)

- North Jersey Real Estate Tips & Strategies (2)

- North Jersey Real Estate Trends (3)

- North Jersey Relocation (2)

- North Jersey Relocation Trends (1)

- North Jersey Rental Market (1)

- North Jersey Restaurant Guide (1)

- North Jersey restaurants (5)

- North Jersey Scenic Drives (4)

- North Jersey School District Guides (1)

- North Jersey Shopping (1)

- North Jersey Short Sale Education (1)

- North Jersey Travel & Attractions (1)

- North Jersey Weekend Events (5)

- North Jersey Weekend Events & Festivals (5)

- North Jersey Weekend Guide (1)

- NYC Commuter Real Estate Insights (1)

- Open House Guides (1)

- Outdoor Activities and Recreation (1)

- Outdoor Activities in NJ (1)

- Outdoor Activities in North Jersey (1)

- Outdoor Lifestyle North Jersey (1)

- Outdoor Living & Recreation (1)

- Outdoor Recreation (1)

- Paramus and Bergen County Homebuyer Resources (1)

- Paramus and Bergen County Market Insights (1)

- Paramus and Bergen County Real Estate Market (1)

- Paramus Homeownership and Savings (1)

- Paramus Homes for Sale (1)

- Paramus Lifestyle & Dining (1)

- Paramus NJ Attractions and Family Activities (1)

- Paramus Property Market Updates (1)

- Paramus Real Estate & Community Guides (1)

- Paramus Real Estate & Lifestyle (1)

- Paramus Real Estate Market Insights (3)

- Parks & Outdoor Life (1)

- Passaic & Bergen County Homes (1)

- Passaic & Bergen County Life (1)

- Passaic & Bergen County Real Estate (6)

- Passaic County Communities (1)

- Passaic County Community Events (1)

- Passaic County estate sales guide (1)

- Passaic County Family Activities (1)

- Passaic County Growth (1)

- Passaic County Home Selling Strategies (1)

- Passaic County Homes (4)

- Passaic County Housing Market Updates (1)

- Passaic County Lifestyle (1)

- Passaic County Lifestyle and Events (1)

- Passaic County Market Insights (5)

- Passaic County Market Updates (1)

- Passaic County Nature & Parks (1)

- Passaic County NJ Real Estate (1)

- Passaic County Probate (1)

- Passaic County Real Estate (8)

- Passaic County Real Estate Insights (1)

- Passaic County Real Estate Market (4)

- Passaic County Real Estate Market Insights (2)

- Passaic County Real Estate Tips (3)

- Paterson & North Jersey Housing Market (2)

- Paterson & Passaic County Real Estate (2)

- Paterson Dining (1)

- Paterson Home Buying Guides (1)

- Paterson Multi Family Investment Guides (1)

- Paterson NJ Attractions (1)

- Paterson NJ Business Opportunities (1)

- Paterson NJ Community & Economy (1)

- Paterson NJ Homes for Sale (1)

- Paterson NJ Investment Opportunities (1)

- Paterson NJ Lifestyle (2)

- Paterson NJ Neighborhood Guides (3)

- Paterson NJ Real Estate (4)

- Paterson Small Business Support (1)

- Pet-Friendly Activities (1)

- Pet-Friendly Living (4)

- Pre-Sale Home Improvement Tips (1)

- Preparing a Home for Sale in North Jersey (1)

- Preparing an Estate Home for Sale (1)

- Preparing Your Home for Sale (1)

- Private School Neighborhoods (1)

- Probate & Estate Real Estate (3)

- Probate & Estate Sales in New Jersey (1)

- Probate & Inherited Property Sales (4)

- Probate & Inherited Property Sales in New Jersey (1)

- Probate & Short Sale Expertise (2)

- Probate & Short Sale Real Estate (4)

- Probate and Estate Home Selling Guides (1)

- Probate and Estate Sale Guidance in North Jersey (1)

- Probate and Estate Sales in New Jersey (2)

- Probate and Inherited Homes (1)

- Probate and Inherited Property Sales (2)

- Probate and Short Sale Advice (1)

- Probate and Short Sale Guidance (1)

- Probate️️️ Probate & Estate Home Sales in New Jersey (1)

- Probate Property Investment Strategies (1)

- Probate Real Estate in Essex County (1)

- Probate Real Estate in New Jersey (3)

- Probate Real Estate in North Jersey (19)

- Probate Real Estate in Passaic County (2)

- Probate Real Estate Insights (3)

- Probate Real Estate Investing (1)

- Probate Real Estate Investment Opportunities (2)

- Probate Real Estate North Jersey (1)

- Property Taxes and Market Trends (1)

- Property Values (1)

- Public & Private School Resources (1)

- Public Schools & Education (1)

- Real Estate & Community Guides (3)

- Real Estate & Community Life (1)

- Real Estate & Local Area Guides (1)

- Real Estate and Community Living (4)

- Real Estate and Local Living in Passaic County (2)

- Real Estate and Neighborhood Guides (2)

- Real Estate and Neighborhood Insights (1)

- Real Estate and Neighborhood Tips (1)

- Real Estate Buying Guides (1)

- Real Estate Deals & Opportunities (1)

- Real Estate Development (1)

- Real Estate Education (1)

- Real Estate Expertise and Market Education (1)

- Real Estate Financing (2)

- Real Estate for Parents (1)

- Real Estate for Working Parents (1)

- Real Estate Forecasts (3)

- Real Estate Guidance for Executors & Families (1)

- Real Estate Investing & Market Insights (1)

- Real Estate Investing & Wealth Building (1)

- Real Estate Investment & Market Trends (1)

- Real Estate Investment & Networking (1)

- Real Estate Investment in North Jersey (2)

- Real Estate Investment Strategies (1)

- Real Estate Lifestyle (1)

- Real Estate Lifestyle Tips (1)

- Real Estate Market Guides (1)

- Real Estate Market Insights & Affordability (1)

- Real Estate Market Timing & Trends (1)

- Real Estate Market Updates (1)

- Real Estate Near Creative Hubs (1)

- Real Estate Near Dog Parks (1)

- Real Estate Pricing Strategy (1)

- Real Estate Success Stories & Case Studies (1)

- Real Estate Tax & FIRPTA Guides (1)

- Real Estate Tax Tips for Sellers (1)

- Real Estate Tips (3)

- Real Estate Tips & Homebuyer Education (1)

- Real Estate Tips for Buyers and Sellers (1)

- Relocating to North Jersey with Kids (3)

- Relocating with Kids (1)

- Relocation and Migration Trends (1)

- Relocation Tips for Parents (1)

- Renting and Investment Strategies (1)

- Renting vs. Buying (1)

- Restaurants near me in NJ (1)

- Restaurants near me North Jersey (2)

- Restaurants, Bars, and Nightlife in New Jersey (1)

- Retirement Lifestyle (3)

- Retirement Living (3)

- Retirement Planning in NJ (1)

- Saddle Brook NJ Community Guide (3)

- Saddle Brook Real Estate Guide (1)

- Saddle Brook Real Estate Insights (1)

- Safe Neighborhoods in NJ (2)

- School District Comparison (1)

- School District Guides (2)

- School District Home Value (1)

- School District Neighborhoods (1)

- Seasonal & Holiday Celebrations (1)

- Seasonal Events & Local Farms (1)

- Seasonal Guides & Family Adventures (1)

- Seasonal Guides & Travel in New Jersey (1)

- Seasonal Real Estate Tips & Homeowner Resources (1)

- Seasonal Travel & Nature Guides (2)

- Seller Help & Credit Protection (1)

- Seller Prep & Sales Strategy (1)

- Seller Preparation and Home Value Optimization (1)

- Seller Resources (2)

- Seller Tips & Guides (1)

- Selling a Home in NJ (5)

- Selling Distressed Property in Bergen County (1)

- Selling Homes in Paterson NJ (3)

- Selling Homes in Special Situations (1)

- Selling Inherited & Estate Properties (1)

- Selling Inherited Property in New Jersey (1)

- Selling Your Home (1)

- Selling Your Home in North Jersey (3)

- Senior Living (6)

- Senior Living & Downsizing (1)

- Short Sale & Distressed Properties (1)

- Short Sale & Distressed Real Estate (1)

- Short Sale & Foreclosure Help (4)

- Short Sale & Foreclosure Help in North Jersey (3)

- Short Sale & Foreclosure Resources (1)

- Short Sale and Foreclosure Guidance (5)

- Short Sale and Foreclosure Help (2)

- Short Sale and Foreclosure Resources (1)

- Short Sale Basics & Definitions (1)

- Short Sale Education and Strategy (2)

- Short Sale Expertise and Guidance (1)

- Short Sale Guidance in New Jersey (5)

- Short Sale Guidance in Totowa NJ (1)

- Short Sale Guides (2)

- Short Sale Homes in New Jersey (1)

- Short Sale Qualification Guides (1)

- Short Sale Resources (1)

- Short Sale Resources for Homeowners (1)

- Short Sale Tips & Guides (1)

- Short Sale Tips and Strategies (1)

- Short Sale vs Foreclosure Resources (1)

- Short Sale vs. Foreclosure Guides (1)

- Short Sales (9)

- Short Sales & Foreclosure Help (1)

- Short Sales in North Jersey (1)

- Single Family Homes and Market Trends (1)

- Small Business Tips & Resources (1)

- Smart Real Estate Strategy with AI (1)

- Starting a Business in Paterson NJ (1)

- Step-by-Step Buyer Guides (1)

- Street Murals & Local Creatives (1)

- Suburban Living in New Jersey (1)

- Takeout and delivery NJ (1)

- Teaneck Foreclosure Prevention Resources (1)

- Teaneck NJ Lifestyle and Local Guides (1)

- Teaneck NJ Real Estate and Relocation Resources (1)

- Teaneck Real Estate and Local Market Guidance (2)

- Teaneck Real Estate Guide (1)

- Teaneck Real Estate Market Guides (1)

- Teaneck Real Estate Market Insights (1)

- Teaneck Real Estate Resources (1)

- Things to Do in Jersey City & Hoboken (1)

- Things to Do in Jersey City This Weekend (1)

- Things to Do in New Jersey (1)

- Things to Do in NJ (2)

- Things to Do in North Jersey (15)

- Things to Do in North Jersey / Local Lifestyle (1)

- Things to Do in North Jersey at Night (1)

- Things To Do in North Jersey This Weekend (6)

- Things to Do in Passaic & Bergen County (1)

- Things to Do in Passaic County (1)

- Things to Do in Paterson NJ (2)

- Things to Do in Paterson, Montclair, Jersey City (1)

- Things to Do Locally (1)

- Totowa & Passaic County Real Estate (1)

- Totowa estate sale timeline (1)

- Totowa NJ Community & Lifestyle (2)

- Totowa NJ Living & Lifestyle (1)

- Totowa NJ Real Estate & Community (3)

- Totowa NJ Real Estate & Lifestyle (1)

- Totowa NJ Real Estate Insights (1)

- Totowa NJ Real Estate Market (1)

- Totowa Real Estate Solutions (1)

- Transit and Commuter Living in New Jersey (1)

- Travel & Local Guides (1)

- Union County Real Estate (1)

- Victorian and Colonial Home Resources (1)

- Wanaque Lakeside Homes (1)

- Wanaque NJ Neighborhood Profiles (1)

- Wanaque NJ Neighborhoods (1)

- Wanaque NJ Real Estate (1)

- Waterfront Properties (1)

- Weekend Activities and Guides (1)

- Weekend Activities and Local Lifestyle (1)

- Weekend Events & Things To Do (4)

- Weekend Events in North Jersey (9)

- Weekend Events in Passaic and Bergen County (1)

- Weekend Events in Passaic County (1)

- Weekend Events NJ (1)

- Weekend Getaways (1)

- Weekend Guides (1)

- Weekend Travel & Activities (3)

- Woodland Park Home Prices & Insights (1)

- Woodland Park NJ Homes for Sale (9)

- Woodland Park NJ Real Estate Market Insights (1)

- Woodland Park Real Estate Insights (1)

- Work-Life Balance in NJ (1)

- Zip Code Real Estate Trends (1)

Recent Posts